Are you struggling with overspending and looking for how to save your money? As an income earner, there are plenty of needs to solve and the money available is barely enough. So, it can be frustrating when your hard-earned money seems to slip through your fingers faster than you make it. And no matter how much money you earn, overspending can financially strain you.

But there are practical and effective strategies you can use to gain control over your finances. In this article, you’ll learn how to save money without sacrificing the joys of life. Some of them include:

- Assessing your current expenses

- Setting your financial goals

- Budgeting

- Cutting everyday expenses

- Avoiding impulse buying.

Reading this article will help you break free from the cycle of overspending and guide you towards making more informed financial decisions.

What does it mean to save money?

Saving money simply means setting aside a part of your income for future purposes. It involves making deliberate decisions about your spending and disciplining yourself in the use of money.

Nigerian billionaire and founder of the Tony Elumelu Foundation, Tony Elumelu, put it this way: “If you earn a naira and you don’t save, even if you earn a billion naira, you won’t.”

To cultivate a savings culture in your life, you must adopt a consistent habit of saving a certain amount of your income.

Here are ways you can do that.

9 ways to save money in Nigeria

1. Track your expenses

Tracking your expenses involves actively recording and monitoring your financial transactions. This means keeping a detailed record of the money coming in and going out of your accounts. It includes salary, allowance, cash transactions, bill payments, and other expenses.

Here’s why you need to track your expenses

- Tracking your expenses helps you to recognize the essential and the optional expenses. The essential expenses are money you spend on basic needs like food, shelter, clothing, and transportation. Optional expenses are money you spend on things that are not necessary for survival. For example, the money you spend on Owambe, Asoebi, etc.

- It helps to know those areas which you are overspending and to make better decisions about your financial priorities. Your financial priorities can include saving to start a family or business.

How to track your expenses

To track your expenses you will need to set up a tracking system. This is any method or tool that allows you to keep organized records of your expenses.

You can do this by using a notebook or an expense-tracking app on your phone. Whichever tracking system you use, ensure that it contains the date, category, amount and description.

Your tracking system may look like this:

|

Date |

Category |

Amount |

Description |

|---|---|---|---|

|

2023-05-21 |

Foodstuff |

4,000 |

Weekly food stuff shopping |

|

2023-05-23 |

Transportation |

200 |

Bus fare |

|

2023-05-23 |

Eating out |

800 |

Lunch with friends at work |

|

2023-05-26 |

Electric bills |

1000 |

For the month of May |

2. Set your financial goals

Financial goals are the specific things you want to achieve with your money. These goals serve as direction and focus for managing your finances. Your financial goals can include paying off debts, paying for an online course, and buying a piece of land.

Why should you set financial goals?

- Financial goals help you to prioritise your expenses. They control your savings, spending, and investment decisions.

- By setting clear and measurable financial targets, you can track your financial progress.

How to set your financial goals

- Evaluate your current financial status: Assess your income, expenses, debts, and investments. By looking at all these things, you can know your financial status.

- Determine your priorities: What is most important to you when it comes to money? Do you want to pay off debt, save for an academic programme, or start a business? Knowing your priorities will help you set clear goals.

- Make your financial goals SMART: SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of saying, “I want to buy land,” consider saying “I want to save N1,500,000 to buy land in Ikorodu by next year.”

- Break down your goals: Break down your long-term goals into smaller, achievable steps. This way, they become less overwhelming, and you’ll stay motivated to keep moving forward. For instance, you can have a long-term financial goal to save N900,000 for your traditional marriage in 2 years. You can break it down by saying, “I’ll save N37,500 every month for 2 years.”

- Create an action plan: Make a plan with clear steps to reach your goals. This could mean making a budget, spending less, increasing your income, or investing. Be specific and practical in your plan.

- Monitor and review your progress: Check your progress toward your goals and make adjustments if needed to stay on track.

3. Work with a budget

Budgeting means creating a plan on how to spend, save, and invest your money. It also entails tracking your income and expenses to ensure you manage your finances well.

Budgeting doesn’t mean that you should not spend or enjoy your money. Instead, budgeting helps you to allocate your money to specific areas of your needs intentionally. For instance, you can create a monthly budget on how to spend your salary. In the budget, you will have your basic needs like food, water, transport, and electricity bill. The budget will also carry other expenses like eating out and hanging out.

Why do you need a budget?

- It helps you plan for your short-term and long-term financial goals, whether it’s saving for a new gadget or any house appliances. For instance, your financial goal can be to buy a refrigerator, pay off a 1-year loan, and save N50,000 for Christmas vacation.

- With a budget, you will have better control over your spending. It helps you set limits and allocate specific amounts to different categories. This ensures that you spend within your limits and avoid overspending on non-essential items. You can set a spending limit on things like Asoebi and weekend hangouts. For instance, if you set a spending limit on an upcoming Asoebi for your friend. With the limit, you can avoid other expenses that will not be necessary or too extravagant for the event.

- It reduces financial stress and allows you to make confident choices about your money.

Steps to creating a realistic budget

- Determine how much money you make. This includes money from your regular job, extra job and allowances, etc.

- Group your expenses into important categories: rent, food, transportation, entertainment, education, and savings. This will help you see where you spend your money most.

- Classify the categories into fixed and variable expenses. Fixed expenses are expenses that stay the same every month. For example, rent is a fixed expense because you pay the same amount each month or year. It can only change if there are specific circumstances or agreements. Variable expenses are expenses that can change from month to month. They are often related to personal choices and preferences. Example of these expenses includes food, clothing, and entertainment.

- Allocate your income to fixed and variable expenses. Start with basic needs like food, shelter, and transportation. Then assign the amount for savings and optional spending. Optional spending is the expenses that are not essential, they are the things that you desire but are not your pressing needs.

- Review and adjust your budget. If the total amount of money you have allocated to all the items exceeds your income, look for areas where you can cut down.

4. Cut down everyday expenses

This means reducing unnecessary spending on a day-to-day basis. It means being mindful of your spending habits and making choices that prioritise essential needs over wants. This may involve distinguishing between needs and wants, finding alternatives to expensive habits or activities, and being more conscious of your spending decisions. By identifying and cutting back on unnecessary expenses, you can save money and allocate it towards more important financial goals or emergencies.

Why you need to cut down everyday expenses

- You will have more money to allocate towards more important financial goals such as saving to start a business.

- Cutting down everyday expenses helps you to develop good financial habits. This means having more control over your money.

- When you manage your everyday expenses wisely, you can avoid getting into debt.

Tips for reducing everyday expenses

- Spend on what you need instead of the things you want. Your needs include feeding, shelter, clothing and transportation. Your wants are things you desire but are not essential for survival. For instance, buying a new phone, or going on vacation.

- Unsubscribe from paid products and services that you don’t use often or no longer use. Examples include streaming services such as Netflix, software and online services, gym and fitness memberships, music and video streaming services, online gaming, etc.

- Reduce electricity bills through energy-saving practices such as using energy-saving bulbs, turning off the lights and unplugging appliances when they are not in use.

5. Avoiding impulse buying

Impulse buying is making unplanned purchases without carefully considering whether you really need the products or services or not.

It happens when you get excited over a product or service you see, and you feel a sudden urge to have it instantly. It could be a dress, a pair of shoes, snacks, or anything that catches your attention. Sometimes, the temptation comes when the price of the item is cheap or lower than usual.

Why you need to avoid impulse buying

- Impulse buying comes with buyer’s remorse because you almost always regret the purchase.

- You accumulate useless or unwanted items with no resale value. That is, even if you decide to sell the items later, they may have little or no value.

- You can also accumulate debt. When a product or service attracts you and you don’t have cash for it, you might opt for credit to buy it.

What is mindful spending?

Mindful spending is about being smart and thoughtful when using your money. It means thinking and planning carefully before making any purchase.

With mindful spending, you’ll be able to differentiate between wants and needs. It prioritises spending on essential things.

Mindful spending also encourages budgeting. By being mindful of your spending and evaluating each purchase thoughtfully, you will be able to stay within your budget. You’ll also make choices that support your long-term financial well-being.

Tips for practising mindful spending

- Separate your wants from your needs.

- Delay purchases: When you feel the urge to buy something outside your budget, delay the purchase for some time. Often, you’ll realise that the initial urge fades away, and you’ll discover that you don’t truly need the item.

- Limit your expenses: This is placing a maximum amount of money that you’re willing to spend within a specific time frame. For instance, you can decide not to spend more than N1,500 daily. Setting spending limits helps you establish boundaries and control your expenses.

6. Reduce debt

Debt is money you owe another person. Being in debt means that you owe money to a creditor or lender, and you have a financial responsibility to repay that money within an agreed time frame.

Why you should reduce debt

- Being debt-free gives you financial freedom. You’ll have more control over your money when you owe no one.

- Debt can cause stress and anxiety. Hence, being out of debt relieves your stress and gives you some peace of mind, knowing that you don’t owe anyone money.

- When you get out of debt, you’ll be able to increase your savings as you’re no longer sending out money to creditors.

- Finally, you’ll have the opportunity to pursue your financial goals. This can include furthering your education, exploring new career opportunities, or starting a family.

How to pay off debt

- Create a budget for debt repayment: In the budget, identify areas where you can reduce spending and allocate more money towards paying the debt.

- Find ways to reduce the amount you spend every day. When you reduce everyday expenses, you can free up more money that can be allocated towards paying your debts. Consider the following:

- Negotiating the prices of goods and services before making a purchase

- Cooking at home instead of eating out

- Reducing non-essential spending.

- When you have extra money, like an allowance or a bonus, consider using it to make extra payments towards your debt. It reduces the total amount you owe fast because you’re paying more than the minimum required each time.

- Negotiate with the creditor: If you find it impossible to pay off your debts, you should contact your creditor to discuss possible alternatives. They may be willing to lower their interest rates, offer payment plans, or settle for a lump payment — that is paying off the money at once instead of making smaller payments over a period of time. Lump payments are helpful for bank loans because you pay less than you would have if the payments were spread out.

- Consolidate your debt. This means combining all the debts you owe different creditors and getting a new loan from one creditor to repay the old creditors. So, instead of making different payments monthly or quarterly to different creditors, you can simply focus on one payment.

7. Automate your savings

Automating your savings means setting up a system that allows you to save money automatically without any manual effort. It can be a special arrangement with your bank to set aside part of your money. So, under your instruction, the bank takes this part of your money from your main account and puts it in a different one.

Automating your savings is not limited to your local banks. You can also use financial technology (Fintech) mobile applications to automate your savings. Examples of Fintech apps include Opay, Palmpay, PiggyVest, and Kuda Bank.

Why should you automate your savings?

- You’ll become consistent in your savings because you save a fixed amount automatically regularly. It is convenient. Once you set it up, you don’t have to worry about it anymore because the process is already preprogrammed. So, it saves you time and energy.

- Automation reduces the temptation to spend outside your budget. It helps reduce impulsive spending by directing your unused money into your designated savings account.

- Automating your savings instils financial discipline and encourages responsible financial behaviour.

How automated savings work

To automate your savings in your local bank, contact your account manager or go to the bank. Your account manager will guide you through the process.

How to automate your savings in your bank

The following are the steps:

- Frequency and amount: You will decide when and how much you want to be set aside.

- After you have decided on the amount and frequency, the next step is to authorize your bank. They will need your consent to carry out the transfer as you instructed.

- Implementation: The transfer will occur automatically based on your choice.

- Your work becomes to monitor your savings. This allows you to stay updated on the growth of your savings and make any necessary adjustments if needed. Automation savings plans are flexible. If your financial situation changes, you can modify the transfer frequency or the amount of money you want to save.

How to automate your savings on your fintech app

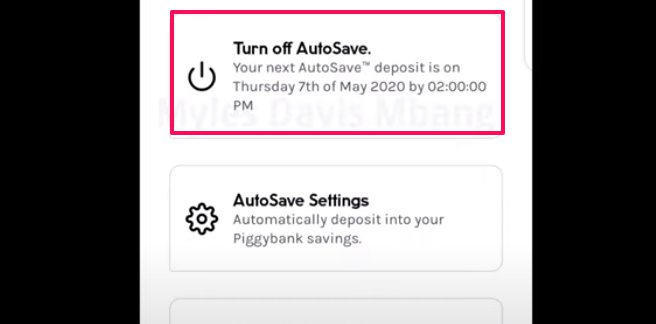

Most fintech apps have automation features. To set up automation in a fintech app, you need to activate the feature in your app. Below are the steps to set up automation in the Piggvest app.

1. Go to the home screen of the app and select Piggybank.

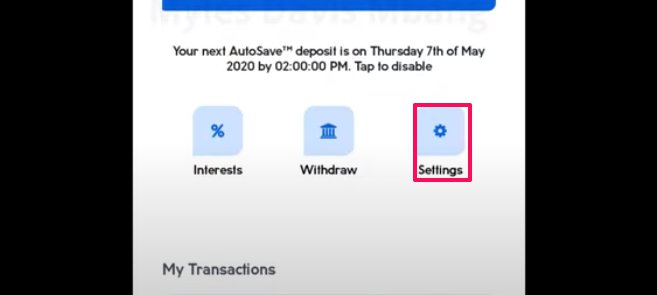

2. Select the settings options.

3. In the settings options, select autosave settings.

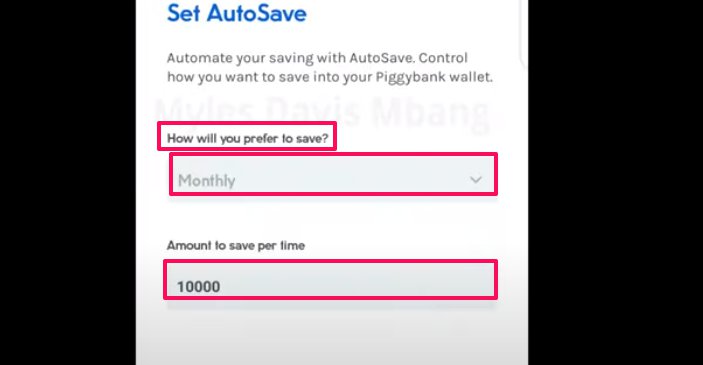

4. In the autosave setting, you’ll see “How will you prefer to save?” and the amount to save per time. Let’s say you choose monthly and N10,000 per time.

5. Finish settings will pop up and options to enter the day you would like the savings to auto-save. You will see select the day and time. Let’s use the 7th of every month and by 2 pm for our example.

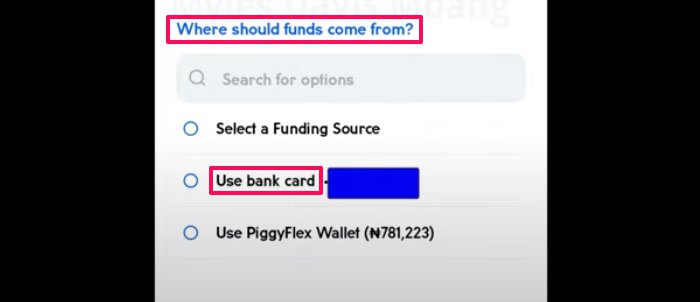

6. Scrow up and select where the money should come from. It could be from your bank account or your Piggyflex wallet. Then select your preference from the options. Let’s say you select your bank account.

7. Then select when you want to start. It can be this month or next month. You can click on next month.

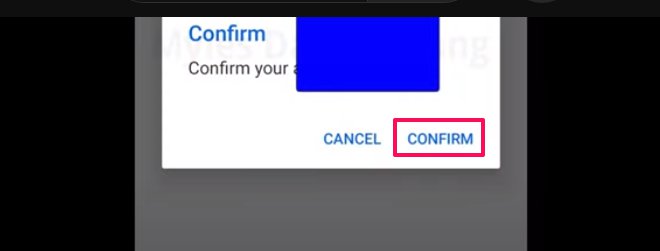

8. The next step is to confirm savings.

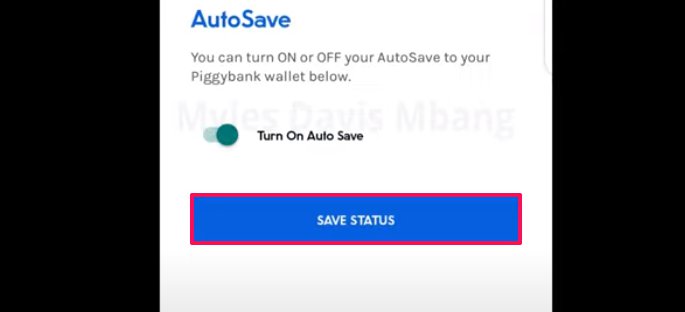

9. After confirming it, go back to the settings options and turn on Autosave.

10. Then on the auto-save and save the settings.

8. Use money-saving apps

Money-saving apps are applications that you can install on your smartphone to help you save and manage your finances. Most of these apps have similar features such as budgeting, expense-tracking, savings automation, and investment features.

Why you need a money-saving app

- Money-saving apps encourage consistent saving habits with features like goal setting and automation.

- A money-saving app helps you manage your finances better by providing a clear overview of your income, expenses, and savings.

- Money-saving apps are easy and convenient because they allow you to save money using your phone or computer. You can set goals, track progress, and make transfers easily, all in one place.

- Money-saving apps help instil financial discipline by providing reminders, setting spending limits, and offering insights into your saving progress.

- Tracking and monitoring: With a saving app, you can easily track and monitor your savings progress in real time. This visibility helps you stay on top of your financial situation, make adjustments if needed, and celebrate milestones along the way.

How to choose the best money-saving app

- Consider the app with features that align with your savings goals and needs.

- Check how easily you can find your way around the app. Go for a user-friendly interface and user experience.

- Consider the security measures and privacy policies of the app. Ensure that your personal information and financial data are protected and kept confidential.

- Look for apps that provide reliable customer support channels. These channels include email, chat, or phone numbers. These will assist you in contacting the app managers if you encounter any issues using the app.

Top money-saving apps in Nigeria

- PiggyVest

- Cowrywise

- OPay

- Kuda Bank

9. Practice DIY and maintenance skills

DIY stands for Do It Yourself. So, instead of hiring people to do some maintenance for you, whether at your home or your office, you can learn to do it yourself and save money. For instance, if the sink in your kitchen stops working, you can save the money you could have used to hire a professional by repairing the sink yourself.

Some examples of maintenance skills you can learn include:

- Servicing generators

- Fixing little electrical problems like changing bulbs and switches

- Servicing gas cookers

- Lubricating door handles

- Removing a drain blockage.

Why you need DIY and maintenance skills

- DIY skills help you save money you would have spent on things you can fix yourself.

- It can save you during an emergency. For example, if your pipe starts leaking water, you can use the skills to fix it temporarily until a professional plumber arrives.

- Being able to handle basic repairs and maintenance or other areas of your life gives you a sense of independence.

- DIY also helps you learn new things.

How to develop basic DIY skills

- Start with the skills you’re already familiar with, such as assembling furniture and fixing door handles or bulbs. This is, you start small, and it gives you the confidence to learn more advanced skills.

- Learn from someone. This person might be a friend or even your family member who knows some basic maintenance skills. They can give you valuable tips, demonstrate your skills, and offer to work on a project with you.

- Do your research. Youtube is a good place to learn some DIY and maintenance skills. Follow the step-by-step instructions given by the tutor in the videos and pay attention to safety measures.

Conclusion

Saving is one way to ensure your financial security. When you act on the strategies for saving money outlined in this guide, you’ll better manage your money and make a great positive impact on your finances.