Are you passionate about your current job and dream of achieving financial prosperity and security without having to switch careers? It is possible to have a life filled with purpose, where you’re deeply connected to your job, with immense satisfaction and joy. But one thing is to have a job you love, and another thing is to get rich from it.

In a world where financial freedom often seems reserved for the privileged class or those involved in high-risk endeavours, it’s reasonable to worry about getting rich from your job. You have responsibilities to handle, several plans to accomplish, and adventures to try out.

So, is it possible to get rich with a “normal” job in Nigeria? Absolutely.

Whether you’ve tried some strategies and failed or you don’t even have one, you don’t have to worry anymore. In this article, we’ll show you 7 simple and effective ways that can help you accumulate wealth while maintaining your beloved job. Some of them include:

- Setting financial goals

- Creating a budget

- Saving money

- Investing money

- Managing debt.

At the end of this article, you’ll learn the top strategies to get rich from your job. By following these principles, you will gain invaluable insights into building wealth, allowing your current job to become a stepping stone towards financial abundance.

How to get rich with a normal job in 10 trusted ways

Getting rich from your job is not like a Ludo game where you roll a dice hoping to get a six. You have to remove the probability from the picture and follow a plan. Here are 10 strategies you can apply to get you there faster than you imagined.

1. Determine what being rich means for you

The idea of being rich is relative. It means different things to different people as individual perspectives, values, and aspirations influence it.

For example, in this interview with nine financial planners, each of them had a different view of what being rich means. Two stood out. One of the financial planners feels that being rich is having the ability to spend on your needs and wants while the other sees it as the ability to quit working and maintain the same lifestyle.

Everyone has their definition of being rich.

For you, being rich could mean having a significant amount of money and financial resources that allow you to live a comfortable lifestyle.

It could also mean having a lot of money, owning a mansion, driving an expensive car, or being able to help people who are in need. It could mean anything you care about.

The point here is to define it yourself.

2. Determine what a “normal job” means for you

You may already have a mental picture of what a normal job should be. However, to amplify it, here are 4 points you may consider:

Legality: Assuming you believe in following due process, you may consider a normal job as one that is in agreement with the laws of Nigeria. For example, working as a civil engineer in a construction company in Nigeria is legal, so you may see it as a normal job.

Steady income and benefits: Some people believe that a normal job should offer consistent income in the form of salaries or wages and benefits such as health insurance. For example, a federal government job in Nigeria offers a consistent salary and part health insurance.

Career growth opportunities: You may see a normal job as a place where you can grow your career through constant promotion—That is, a place where you constantly improve your skills and get rewarded for it. For example, working in an established company like a brewery as a marketer.

Fixed working time: Some people see a 9 to 5 as a normal job. Because they are time-conscious, they see any job that makes them work at odd hours or in their spare time as an abnormal job. For them, a normal job should have a starting and closing time.

3. Choose the path that makes sense for the kind of wealth you aspire to

The strategies you need to use to get rich from a normal job depend on what being rich means for you. If being rich simply means having enough money to feed three square meals, saving, investing wisely, and avoiding debt, then a job that pays well might do.

For example, working as the head of sales at Dangote Cement may guarantee good pay. To get rich, therefore, you could focus on just saving, investing, and avoiding debt.

But if being rich means taking expensive vacations, buying lots of houses, etc., you’d need to do something extra like starting a side business, investing, taking equity in a company (more on this later), or changing jobs often. The goal of changing jobs often is to increase your salary, especially if you are working with Nigerian companies.

For instance, Oprah Winfrey worked as a radio presenter before starting her own business, which made her a millionaire at 32. She wanted something extra, and she got it.

4. Set SMART financial goals

Whether your money goals are ambitious or on average, you should set financial goals. Financial goals are targets you set for yourself to achieve with your money.

Financial goals are about managing your money wisely and making it work for you. Your goal can be to save some money, pay off your debts, start a business, invest your money, or all of the above. Whatever goals you set for yourself should be SMART. This means it should be specific, measurable, attainable, realistic, and time-bound.

To emphasise the importance of setting SMART financial goals, Brian Tracy, an American author of Goals!, says: “Most people are hopelessly confused about their financial goals, but when you become absolutely clear about them for yourself, your ability to achieve them increases dramatically.”

You need SMART financial goals to keep you on track and ensure you have a well-thought-out plan for your money. It’s easy to lose focus on what you want to do with your money, but having SMART goals will help you stay committed to your dreams of getting rich on a normal job.

How to set financial goals

1. Set your goals one area at a time: Based on this guide, you have about six areas to set goals around. They include: saving, budgeting, investing, debt management, maximising income, and developing a good mindset and habits. Pick them one at a time and set goals for them. To illustrate the process of setting a goal here, we’ll pick “saving”.

2. Make the goals SMART: A SMART plan means a specific, measurable, attainable, and time-bound goal. Using saving as a focus area, here is an example of a SMART goal you can set: saving 20% of your salary for the next 5 years. Let’s break it down:

- Specific: Our sample goal states the exact thing you want to do. That is saving 20% of your salary.

- Measurable: The goal is measurable because it defines the exact percentage of salary you’ll save (20%) and the duration (5 years).

- Attainable: Determining whether this goal is attainable depends on how much you earn and your standard of living. Assuming you earn N100,000 a month, live a modest life, and don’t have so much responsibility, saving N20,000 a month is attainable.

- Realistic: Knowing that getting rich is your top priority, saving 20% of your salary is something you can do for the next five 5 years. You won’t have to worry about taking out money from your savings or your other needs and wants since you have 80% of your salary.

- Time-bound: The goal is time-bound because it clearly states this will happen for 5 years.

3. Track your goal periodically to ensure you’re following the plan: In our investing example, you will most likely set a monthly reminder since you’re paid monthly. Once you get the reminder, ensure you transfer the 20% from the salary account to your special savings account.

4. Automate your goals: Although you may not be able to automate all goals, you can easily automate some. Using our savings example, you can use apps like PiggyVest and Cowrywise to automate your monthly saving goals. All you do is set the time and date for the app to debit your account. Once you receive your salary, the app automatically removes the 20% monthly savings target into a separate savings account on the app.

5. Use free project management tools like Trello to set, organise, and track your goals: You may have a lot of goals, and it can be overwhelming. Using project management helps you stay organised, get automated reminders, and track the progress of your goals.

5. Create a budget

A budget is a plan detailing how you’ll spend your income. In budgeting, you allocate money to your needs and wants before spending.

The writer and publisher, William Feather, explains a financial budget in an interesting way: “A budget tells us what we can’t afford, but it doesn’t keep us from buying it.” So even with budgeting, you still have to be disciplined in spending.

Getting rich is not usually an accidental process. Assuming you want to get rich from your job, you should budget for savings, investing, spending, paying off debts, and emergencies.

Here are reasons why you need to create a budget:

- To watch your spending habits: When you create a budget and follow it, you will only spend money on things you have.

- To avoid overspending: Budgeting is the best way to control overspending. For example, when you exhaust the money allocated to a particular want or need, you will have no choice but to stay without it because the only money you have left has been earmarked for other needs and wants.

- To stay on track with your goals: Budgeting allows you to consider your financial goals and allocate funds to see that you achieve them. For example, this is where the 50/30/20 rule comes into play. You allocate 50% of your earnings to your needs, 30% to wants, and 20% to savings.

- To pay off your debts and have peace of mind: Paying for debts should be part of your budget if you are indebted to anyone. Budgeting helps you pay back your debts consistently until you’re free from them.

How to create a budget

Here are actionable steps to budgeting for yourself:

- Determine your monthly income: If you earn a salary, this is straightforward since you know your monthly salary. But, if you’re a freelancer, you may need to calculate your average monthly income.

2. Define your budgeting priorities: What area do you want to improve on financially? What do you spend monthly? List them out on paper.

3. Classify your list: After you have listed your priorities, classify them into headings. For example, you can have:

- Needs: Food, clothes, etc

- Wants: Netflix, hangouts, etc.

4. Decide on how to allocate your money: Use the 50/30/20 budgeting rule. This rule is about keeping 50% of your salary for your basic needs, such as food, clothes, and rent, allocating 30% to wants like Netflix subscriptions and hanging out with friends, and investing and paying off debts with the remaining 20%. But you can adjust the percentages to suit your needs.

5. Use budgeting tools and apps to allocate specific amounts to each item on your list. Here you go into details. If you think you need N30,000 monthly to buy food, you specify it. Use tools such as Google Sheets and Microsoft Excel and budgeting apps like YNAB (You Need a Budget), Goodbudget, and MyMoney to type and track your budget. You can easily download the apps and a few videos on YouTube to understand how to use them.

6. Start saving

Saving means putting a portion of your money away for future use instead of spending it all right away. It’s keeping some of your salary or income in a safe place, like a piggy bank or a designated savings account, so you can use it later when you need it or have a specific goal in mind.

There are several reasons to save money such as investing, emergencies, and retirement. But as someone who wants to grow your wealth, you want to focus on saving for investing in opportunities.

But let’s be clear about this: if being rich means taking expensive vacations, buying lots of houses, etc., you can’t save your way to that. You need to be a lot more strategic and understand how money works.

For example, instead of just saving alone, you can save and start a business. Instead of taking a salary, you can take equity. If a company becomes valued at N1 Billion in the future and you have 5% equity, you’ve already made your first N1 billion.

Of course, it means you share risk, but that’s how it works if you want to achieve that kind of wealth.

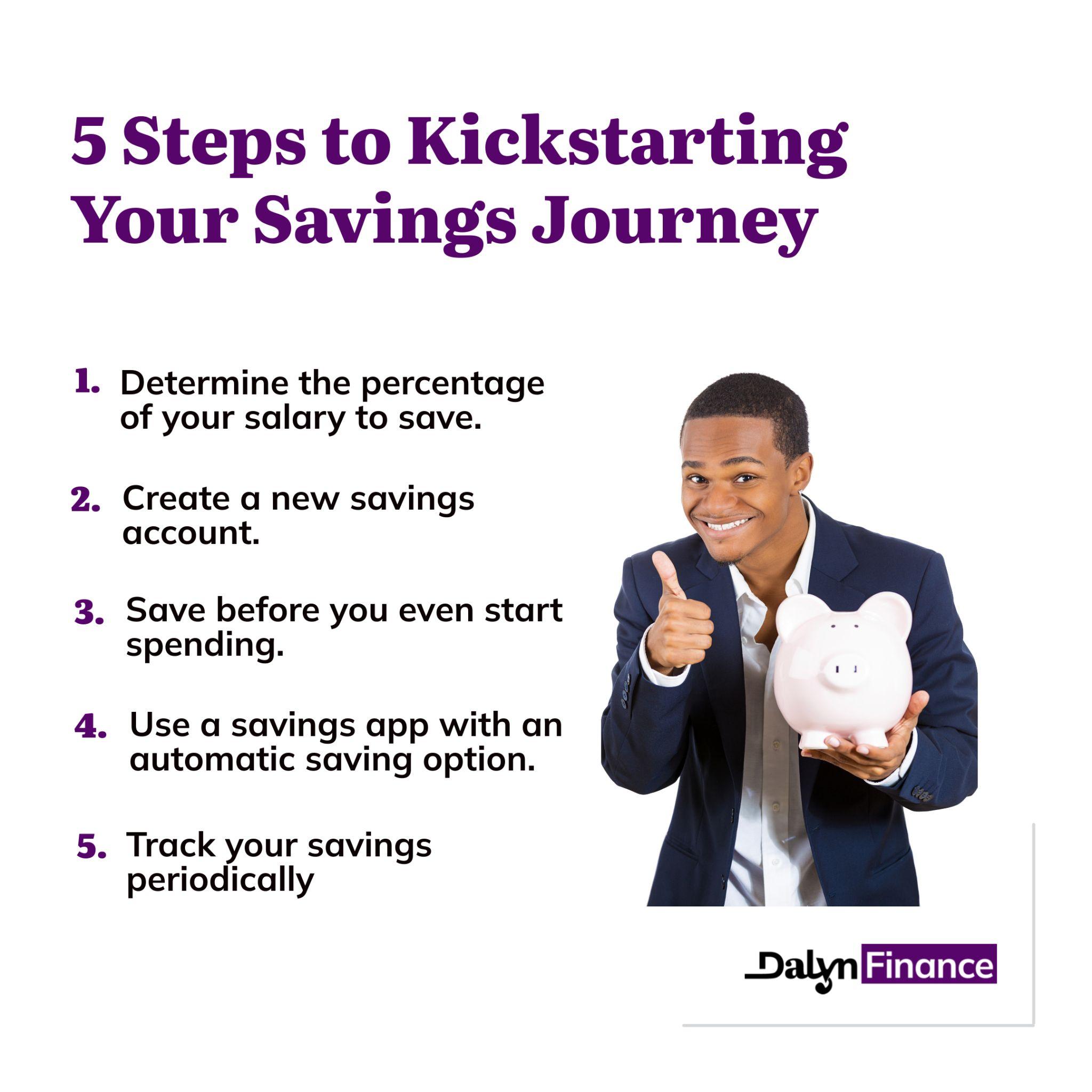

How to start saving

Here are steps to follow to start saving:

1. Determine the percentage of your salary you should save: This is where you also use the 50/30/20 rule. The 20 stands for saving 20% of your salary. So if you earn N100,000 monthly, 20% of it is N20,000. But if you feel this percentage is small, you can increase it to an amount you’re comfortable with.

2. Create a new savings account in any commercial bank of your choice or use an old one you already have. You may even use a savings app like PiggyVest.

3. Pay yourself first by saving before you start even spending. For instance, if the amount you have budgeted to save out of your salary of N100,000 is N20,000, the first thing to do when you receive your monthly salary is to save N20,000. That means you’re prioritising your savings.

4. Use a savings app with an automatic saving option: These apps help you save assuming you forget. It also saves you the time of having to set your money aside manually. Apps like PiggyVest and Cowrywise are great for automatic saving. Otherwise, you can create a designated savings account with any bank of your choice and save manually through transfers.

5. Track your savings periodically to make sure you’re following your plan: This not only reminds you of the importance of your savings habits, but it also motivates you to continue saving for your future goals.

7. Maximise your income

Maximising your income means finding ways to increase or use your money wisely. It involves actively seeking opportunities and using strategies to enhance your earning potential.

Here is some advice by George Clason about maximising income from his book The Richest Man in Babylon: “Every gold piece you save is a slave to work for you. Every copper it earns is its child that also can earn for you. If you would become wealthy, then what you save must earn, and its children must earn….”

There are several reasons you may decide to maximise your income as someone who wants to get rich:

- To provide a solid foundation of financial security: With a higher income, you can meet your financial obligations and have a greater sense of stability.

- To put you in a better position to achieve your financial goals: Whatever your goals, having more money enables you to progress towards them more quickly and effectively.

- To improve your standard of living: With more money comes the possibility to enjoy your life, pursue your hobbies, and engage in activities that make you happy.

- To increase your options and freedom: Having more money empowers you with more choices when it comes to career decisions, where you live, or the lifestyle you want for yourself.

Here are some ways to maximise your revenue:

- Learning extra skills or improving on them: This will help you become more efficient and effective at your job, and it’s the best way to get a pay raise.

- Take up an additional job provided it doesn’t interfere with your main job. For example, if you work full-time as a graphic designer on weekdays, you may take up freelance graphic design jobs and deliver during weekends.

- Renegotiating your salary to get paid what you deserve: This is a step you take when you have developed new skills, gained more experience, and taken on additional roles.

- Spending and investing wisely by making thoughtful considerations before letting go of your money. For example, before investing in an asset, conduct thorough research; and before buying an item, double-check to ensure you need it.

8. Start investing

Warren Buffet, one of the most successful investors in the world, describes investing as: “the greatest business in the world.” Investing means putting your money into an asset with the hope of reaping future profits. It is like planting seeds with the hope that they will grow into something bigger and more valuable in the future.

Instead of just spending your money on your needs or wants right now, investing is a way to use your money to make more money over time.

For instance, if you think the value of a piece of land in a particular location will appreciate over time and you buy it, you have invested.

Here are reasons to invest:

- Investing can help you build wealth over time. For instance, instead of keeping your money in the bank or spending it all at once, you can put it into something that has the potential to earn you more money in the future.

- You avoid inflation through investing. Inflation occurs when the prices of goods and services increase with time, therefore decreasing the quantity of goods and services you can buy with a certain amount of money. Therefore, inflation reduces the value of your money, but investing in assets ensures you earn more when you sell the asset under inflation.

- Investing helps you raise huge capital to pursue bigger dreams. If you invest your savings from your normal job in something and it starts to yield profits, you can put it into a business idea to yield more profit.

- Through investing you have multiple sources of income. For someone like you with a 9-to-5 job, investing is a way to buy more time and earn more. Your money works for you to accumulate more money while you work your normal job.

There are various ways you can invest your money in and outside Nigeria. They include:

- Storage: For storage, there are a lot of products you can invest in such as palm oil, Mellon, and honey. Using Mellon as an example, you buy them in bags from farmers during the harvest season and store them in a dry room until planting season. During the planting season, there is a high demand for Mellon and less supply of it, so selling the ones you stored then will yield you profit.

- Real estate: Real estate is land and any other fixed property attached to land like houses. Depending on how much you want to invest, you can buy land from any region in Nigeria. But you have to invest strategically in places with the potential for development. That’s how the value of your investment appreciates.

- Starting a side business: Although starting a side business is not easy, its reward is the most sustainable. There are different side businesses you can combine with your job such as freelancing, POS business, home lessons, etc. You can either do these businesses part-time on weekends or employ someone to run them while you supervise them.

- Cryptocurrency: This is a form of digital money secured by thousands of interconnected computers spread all over the world. Examples of cryptocurrencies are Bitcoin and Ether. Just like the paper money we use, cryptocurrencies appreciate when there is an increase in demand for them. For example, you can buy some Bitcoin at a low price and sell it when it appreciates. Binance and Kucoin are good places to buy cryptocurrencies. They are one the largest crypto marketplaces and have been around since 2017. To get started:

- Download one of the apps from the app store and sign up.

- Buy some digital dollars (USDT) with naira using the peer-to-peer option.

- Buy your preferred cryptocurrency.

- Investment apps: Investment apps like PiggyVest and Cowrywise offer investment options for users with at least 10% interest per year. So, if you invest N100,000 for instance, you’ll be having about N10,000 interest yearly. To invest for example:

- Download an app like PiggyVest from the app store and sign up.

- Deposit some money into it using your debit card.

- Subscribe to one of the numerous investment packages on it.

6. Stocks: Stocks are assets that represent a stake in a company or business. Buying the stocks of a company is like buying a part of the company. And when you buy the stocks of a company you have the right to profit from the company and be part of the decision-making process of the company.

Stocks work just like real estate and cryptocurrencies where you make a profit after the value of your stock appreciates. You can buy stocks of foreign and local companies using apps like Bamboo and Risevest for as low as N2,000. To get started:

- Download the app on the Play Store and sign up.

- Fund it using your debit card.

- Choose the stocks to buy.

7. In yourself and the people around you: The best way to invest in yourself is by learning high-income skills and furthering your education. For example, you can learn skills such as coding and copywriting, or even take a master’s degree online. Empowering yourself gives you an edge to earn more income.

You can also invest your salary or income in educating and training people, especially starting with your children or family members. It may or may not have an immediate direct reward.

But it pays off in the long run.

When you empower your family members, for instance, you wouldn’t have to take on their financial needs anymore, and you can then add whatever money you formerly spent on them into saving and investing.

While the goal of investing is to make your money work for you, remember that investing involves risks. Sometimes, the value of your investment may go down. So, it’s important to research before investing in anything.

Some investments are safer than others, but they may not bring as much profit. But by investing, no matter how small, you get a chance to make your money grow and have more in the future.

9. Manage your debt

Managing debt means effectively handling the money you owe to other people. It is making plans to ensure that you repay the borrowed money on time. It involves keeping track of how much you owe, setting aside money regularly, making small instalments over time until the debt is fully repaid, and not borrowing more than you can handle. Overall, it’s about being a responsible and reliable debtor.

There are two cases when you should care about managing debt: when you owe someone and when you plan to borrow. So, if any of two applies to you, here are reasons why you should consider debt management:

- Paying debts can be burdensome, but with debt management, you have a plan you follow to consistently pay back in small amounts that won’t affect your finances so much.

- Debt management helps you minimise the amount you pay as interest. The more you pay regularly, the less interest you pay because the total amount you owe reduces.

- Managing your debt and paying up regularly shows lenders that you’re highly responsible, and they will be more likely to lend you money in the future.

- Debt can cause you a lot of worry but managing it through consistent payment gives you peace of mind, because you know you have your finances under control.

- Managing your debt takes you closer to your goal of getting rich. Constantly borrowing money from people and not having a payback plan will only weigh you down financially.

How to manage your debt

Here are tips to effectively manage your debt:

- Add your debts to your financial budget.

- Create a SMART debt payment goal to help you make regular payments over time.

- Prioritize debt by starting repayment from the most pressing one.

- Don’t keep borrowing when you have a list of debts to pay off. Concentrate on finding ways to make more money.

- Cut down spending on wants and channel it to paying debts.

- When you borrow, always negotiate lower interest rates, don’t just agree on the lender’s terms without a try.

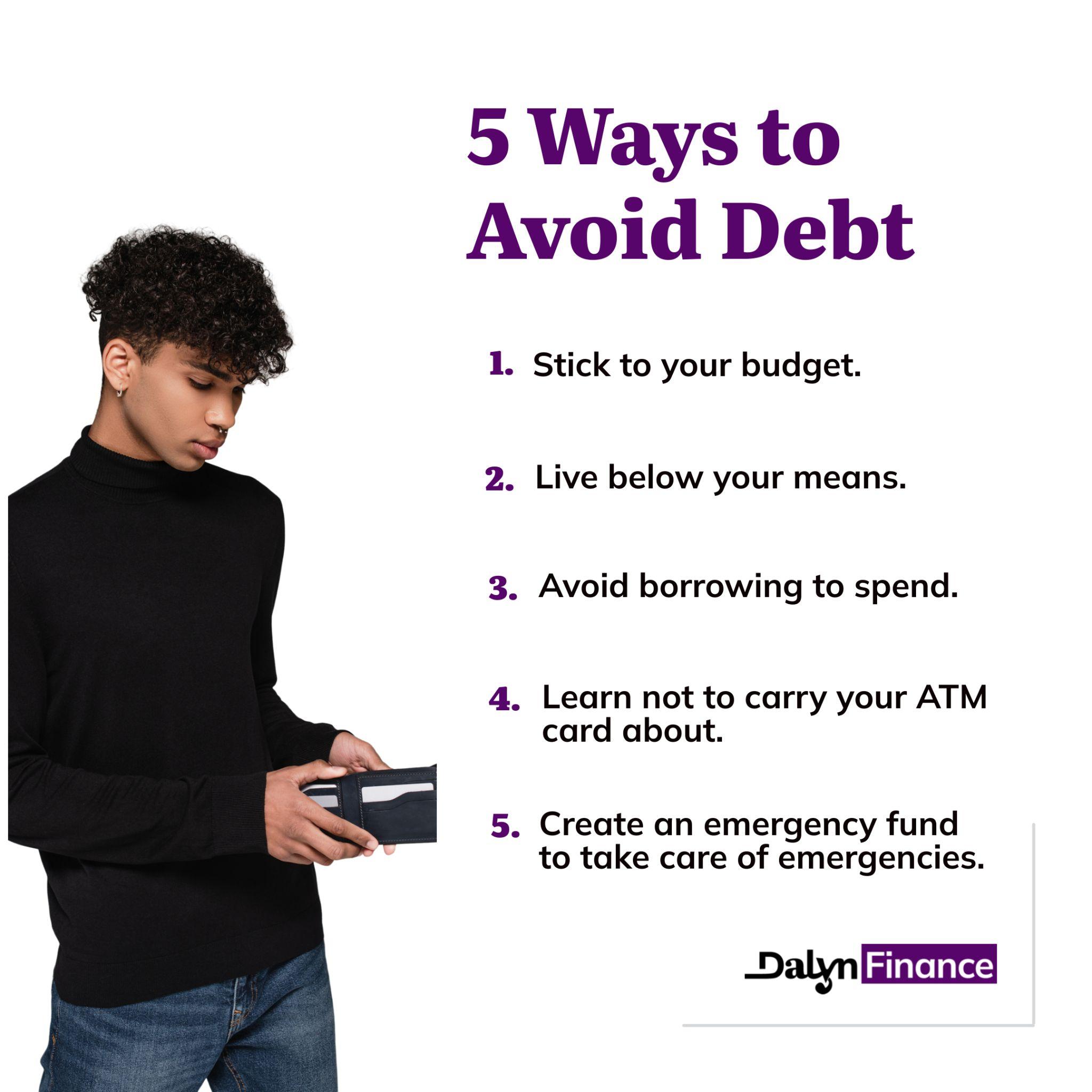

How to avoid debt

Although avoiding debt may not be completely possible, you should only borrow when it’s super necessary such as in a health emergency. Here are ways to avoid debt:

- Have a healthy financial budget and stick to it. Use the 50/30/20 rule of budgeting or modify the rule to suit you. Having a budget also prevents impulse buying.

- Avoid visits to locations or hanging out with people who will push you into borrowing to spend.

- Live below your means. If you can’t afford an item, don’t go for it. The most fundamental way to tackle this is by pre-allocating your funds to your needs, wants, and savings through budgeting.

- Don’t compare yourself to others. Once you do, these people become your financial life standard, and you may likely borrow to meet the standard.

- Create an emergency fund to take care of emergencies. So instead of borrowing during emergencies, you’ll use your emergency fund.

- Learn not to carry your ATM card about. The best way to cut the temptation of overspending and borrowing is by cutting off the source of the temptation.

10. Develop a good mindset and habits

Developing a good mindset means learning good ways of thinking and behaving that enable you to achieve your goals. Therefore, you consistently stay positive, learn good ways of doing things, and drop the negative ones.

Good habits, on the other hand, are actions you take consistently that help you reach your goals.

As someone who wants to get rich from their job, here are good mindset and habits you should adopt to achieve your goal faster:

- Conducting proper research before making investments to avoid investment scams

- Being intentional about your goals by writing and tracking them to be accountable

- Networking and building relationships with people having similar plans as you

- Living below your means to avoid unnecessary expenses

- Having a conviction that you can get rich from your job: So no matter the temptations and doubts you may occasionally have, strongly believing in yourself will help you.

- Seeking financial advice from people who know more than you.

Developing good habits and mindset will help you reach your financial goals faster.

Imagine that you save half of your salary but have a habit of buying any new flashy gadgets that launch. That habit alone is enough to ruin your financial plan because any time a new gadget is released, you immediately dip your hand into your savings to buy it.

Developing a good mindset and habits towards finance is challenging, but every good achievement has a price tag. Here are tips to help you develop a good mindset and habits:

- Always set a financially SMART goal whether you’re budgeting, saving, investing, or paying back debt.

- Consciously spend your money. Before you buy things, check to make sure you need them. Don’t buy them out of impulse.

- Ensure you save and invest regularly and wisely so that it becomes second nature.

- Keep learning by reading financial books, and blogs, following financial experts on YouTube, and doing your research.

- Have a system for paying off debt. Do it regularly and in bits.

4 essential reasons to get rich in Nigeria

It’s important to understand the reasons why you need to get rich in Nigeria. It will be the fuel that keeps you running on your journey to getting rich. They include:

1. To be free and independent

Being free and independent means doing what you love without asking permission from anyone or worrying about any financial constraints.

If you’re rich in Nigeria, you can start your own business, travel anywhere you want, donate to charity, or do anything you feel is worth it without seeking financial assistance.

2. To ensure financial security

When you’re financially secure, you have enough money to take care of emergencies and unexpected expenses and invest in opportunities. It means you don’t have to worry about money.

You can have emergencies, such as an illness or an accident, so being rich will help you quickly deal with these problems without being an object of public pity.

3. To have an improved standard of living

You can’t live the good life without money. According to a 2022 report from the National Bureau of Statistics (NBS), 63% of people living in Nigeria are multidimensionally poor. This means that in addition to not having enough money and other material things, they don’t have access to their basic needs such as quality healthcare, good water, etc. So they resort to what is within their reach.

A good number of Nigerians can’t afford their basic needs, so they resort to what is within their reach. But being rich will help you afford both your basic needs and wants, making you live a happy and enjoyable life.

4. To create opportunities for your family

Being rich helps you create socioeconomic opportunities for your family. You don’t want your children or family members to become or remain poor.

So, if you become wealthy, you can open up enabling possibilities for your children and loved ones. This can be through giving them the best education that will empower them for life or financially supporting their business endeavours.

5 important tips on getting rich from your normal job

Here are 5 tips to have at the back of your mind to get rich faster from your normal job.

1. Be open to learning and acquiring more skills

Learning new skills will set you apart in your job. No CEO will promote you or agree to negotiate a salary raise with you if you’re not constantly getting better at the job. So, always grab any learning opportunity that can make you earn more.

2. Network and build relationships

The help you seek can be within the reach of someone close to you at your workplace. One rule about building good relationships is to think of the other person. You should find ways to be valuable to them in return for their favour.

3. Aim for quality and excellence

Aim for excellence at your workplace and in all you do. When others give up, try some more. You might get a recommendation for a higher-paying role just for this.

4. Stay patient and persistent

Sometimes it can seem that your effort isn’t paying off. You’re not getting the promotion you’re pursuing, or the skill you’re learning on the side is hard. Keep at it. You’ll be surprised when it starts paying off.

5. Automate repetitive tasks for productivity

Automation helps you save time and resources. For example, using an automated savings app helps you save more for investing. Automating your daily tasks at work will make you more efficient and effective, which can also get you higher pay for the values you offer.

Conclusion

Getting rich from your job will not happen by accident. You have to be dedicated and highly intentional about it. This article has provided you with some practical and effective ways and tips to help make the process easier for you.

By following this guide, you’ll gain invaluable insights into building wealth and allow your current job to become a stepping stone towards your financial freedom.